Are Albanian companies ready to embrace digital transformation? A new study analyzed five sectors of the Albanian economy and revealed areas with the most potential for improvement.

Digitalization is one of the key drivers of innovation, competitiveness and growth in the global economy. The digital economy is equivalent to 15.5% of global GDP and growing 2.5 times faster than global GDP over the past 15 years (World Bank).

Digitalization is also contributing to the innovation of the Albanian economy, where over 98% of businesses use computers and the internet. However, the COVID-19 restrictions created obstacles for all sectors in Albania that were found unprepared for the new challenges. They also created opportunities and strengthened the case for digitalization by stimulating enterprises to embrace it.

RisiAlbania, the youth employment project in Albania, used this momentum to conduct a Market Assessment Study on digitalization that focused on five sectors: finance, agribusiness, tourism, business process outsourcing (BPO) and manufacturing. The study, which was carried out by the Protik Innovation Center, then separately analyzed the supply side – the information and communications technology (ICT) sector. The sample consisted of 180 companies selected from approximately 57,000 companies across the country.

The study goal was to assess the current adoption and availability of digital solutions, and to stimulate market actors to invest in digitalization based on informed evidence.

And the winner is…

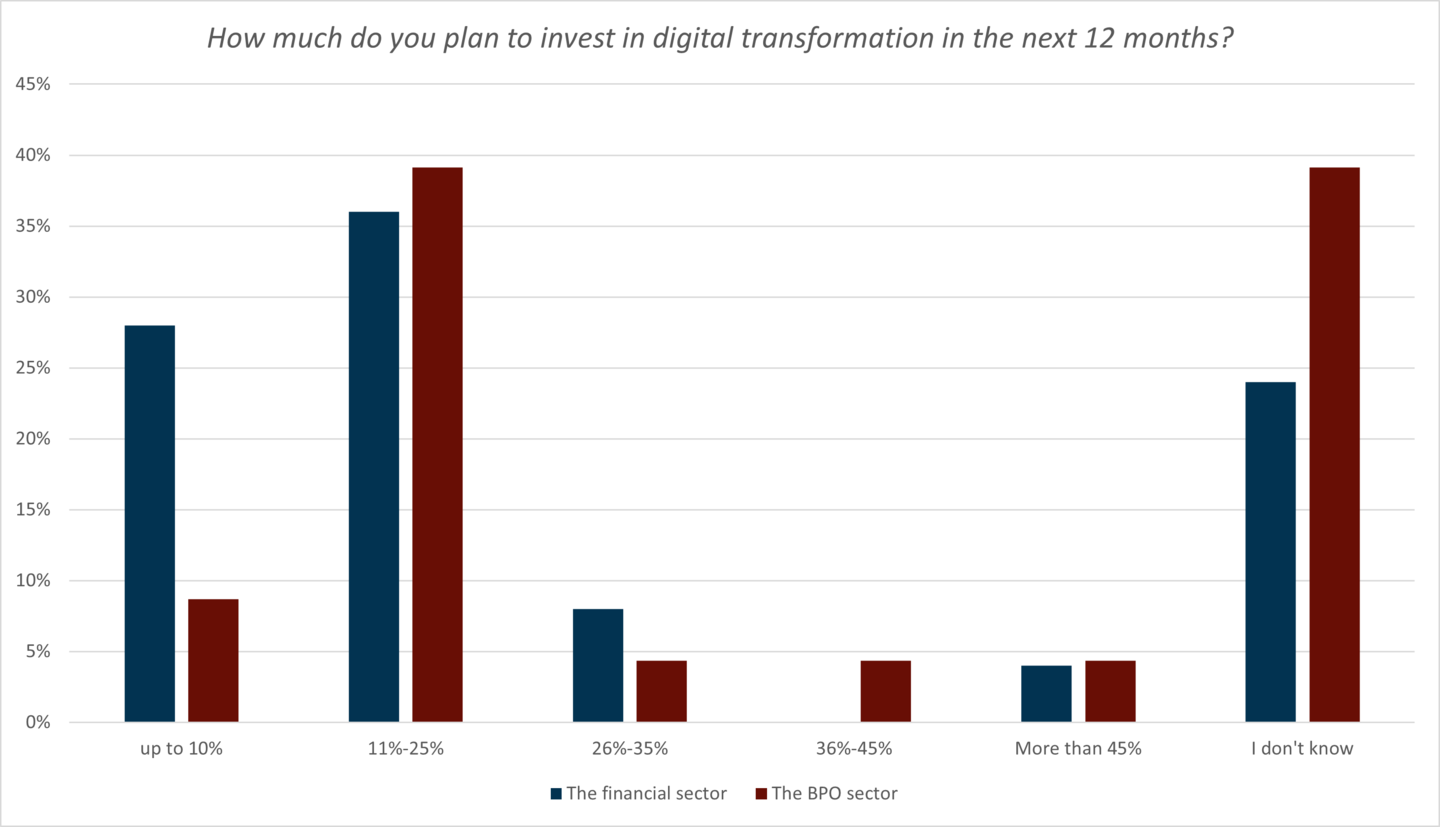

The research revealed that the financial sector is one of the most digitalized sectors in the Albanian economy. Most companies have dedicated staff for managing information systems and have developed strategies and skills for the digitalization of processes. Moreover, over 60% of companies in this sector state that they will increase their investment in digital transformations in their company by up to 25% of their revenues.

The BPO sector follows closely behind, but the research showed that its management is less certain about their plans for digital transformation: almost 40% don’t know how much they would like to invest in the next 12 months.

Where the potential lies: Under-digitalized sectors

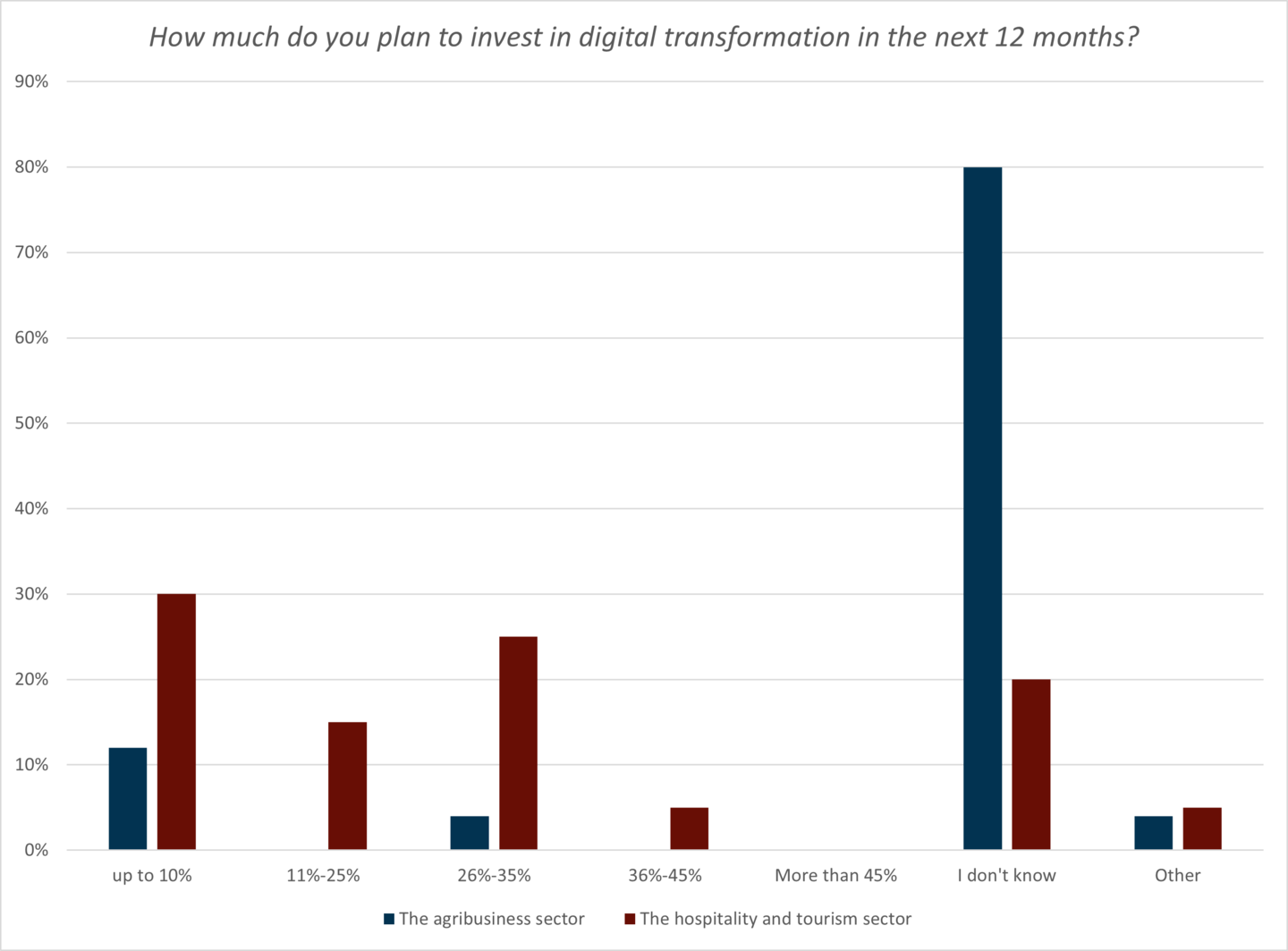

The agribusiness sector is the least digitalized sector included in the study. Survey data show that its investments in digital processes are quite low and limited to the accounting business functions, communications (website, email, social media), and to a smaller degree to digital marketing. The main obstacle to the benefits of digitalization is not only the limited budget of companies, but also the lack of skills to use digital technologies. Less than one-fourth of companies interviewed in this sector have the skills and resources to carry out their digital projects.

Their future plans are bleak: the management does not seem to have a clear vision on this issue. Only 4% of companies have a digital strategy. Only 12% of companies plan to increase investment in digitalization of companies by up to 10% of their revenues.

Hospitality and tourism is another less digitalized sector, but it is much more clear and optimistic about its plans for the future: 70% of companies want to invest up to 35% of their revenue in digital transformation in the next year. They are especially interested in investing in digital marketing and digital payments. This makes sense considering that most of the companies in the sector have websites, but few have hired dedicated staff for digital marketing. Instead, most businesses engage existing employees that are not specialized in digital marketing.

Mapping priorities for investment in digitalization

The study showed that different sectors have different levels of clarity and ambition when it comes to the scale of their investment in digital transformation. But what exactly do businesses want to invest in? According to the study, the main investments of companies will focus on digital marketing (hospitality and tourism, BPO, financial, manufacturing, agribusiness), e-commerce (financial, agribusiness), data analysis (BPO, financial), and robotic process automation (manufacturing). These investments are expected to bring revenue growth, enhance companies’ brand image, and improve decision-making based on data analysis.

Interestingly, 86% of the ICT companies that we surveyed state that the main digital services they will offer soon are in the field of e-commerce, digital payments and digital marketing, which mostly coincides with the demand of the economic sectors that we analyzed. However, the ICT companies admit that they do not have enough staff to implement these plans and that they have to recruit new hires.

Digital transformation: a mindset change

The main root cause for the underutilized potential of digitalization in the tourism and agribusiness sectors is that companies do not believe that there is a business case for investing in digitalization. However, this is changing as they are planning to invest more in digitalization projects. Therefore, ICT companies in Albania need to develop and promote the business case for investing in digital solutions to these sectors.

Other root causes are the lack of technical skills and digital strategy. Digitalization is not only about having IT staff and equipment. The study shows that digitalization requires a mindset change that should be part of the organizational culture. Investments and capacity building of the businesses’ management and their teams in all sectors need to be increased to build their capacity to develop digital projects. Digital skills development should target not only the supply side, the ICT sector, but also the demand side, the different economic sectors, to tap into full the opportunities of digitalization.

Digitalization adds value to products and services and enables companies to innovate and increase their competitiveness and sustainability. It is crucial to see digitalization not only as a growth mechanism but also as a strategy that will lead to sustainable business models and thus create new jobs for young women and men in Albania.

Download the full Market Assessment Study.

Bjona Ziaj, Andi Stefanllari, Lutjona Lula work for RisiAlbania, a project of the Swiss Agency for Development and Cooperation (SDC) implemented by Helvetas and Partners Albania.

This article appeared in the Spring 2022 issue of Helvetas Mosaic. Subscribe to never miss an issue.

Did you learn something new about this topic? Share it and keep the conversation going →

Subscribe to Helvetas Mosaic

Our articles explore new trends and fresh ideas about international development work in Southeast Europe.

Get inspired with our insights.